‘September appeared quiet but quietly reshaped sentiment’: Inside Finestel’s September Crypto Market Report

Finestel’s September 2025 Crypto Market Report revealed a quiet transition month where liquidity returned and institutions set the stage for Q4’s next move. Risk appetite returns across assets According to Finestel’s September 2025 Crypto Market Report, September appeared quiet on…

Finestel’s September 2025 Crypto Market Report revealed a quiet transition month where liquidity returned and institutions set the stage for Q4’s next move.

- Finestel’s September 2025 report shows investors quietly adjusting positions, favoring liquidity and structure as markets settled into a more stable, policy-driven environment.

- Bitcoin and Ethereum stayed at the core, but capital slowly moved toward DeFi, tokenized assets, and yield-based strategies backed by stronger fundamentals.

- Clearer rules across major economies improved confidence, encouraging measured inflows into compliant projects and deeper collaboration between banks and on-chain platforms.

- Finestel summed up September as a month of preparation, where discipline replaced momentum and investors focused on building positions rather than chasing rallies.

Table of Contents

Risk appetite returns across assets

According to Finestel’s September 2025 Crypto Market Report, September appeared quiet on the surface but quietly reshaped investor sentiment.

The shift began with the U.S. Federal Reserve’s decision on Sept.18 to cut interest rates by 25 basis points, its first reduction since March 2024. The move followed months of weakening indicators. Job creation fell to 258,000, and consumer confidence slipped to its lowest level since 2023.

While Chair Jerome Powell avoided clear forward guidance, the Fed’s projections revealed internal differences, with some members anticipating further cuts before the year’s end.

Equity markets interpreted the move as a green light to return to growth assets. The Nasdaq rose 3.4% in the week that followed, signaling investors’ renewed appetite for risk.

Crypto traders, often more sensitive to shifts in liquidity and policy tone, took note. Stablecoin inflows rose by $3.1 billion during the month, suggesting that liquidity was entering the ecosystem even if it had not yet been deployed.

Let’s take a closer look at the report to understand where the market may be headed amid these changing dynamics.

Bitcoin steady, Ethereum ascendant

Finestel’s report showed that Bitcoin (BTC) and Ethereum (ETH) held the market steady through September while capital underneath them began to shift.

Bitcoin moved within a narrow corridor of $110,000 to $117,000. The BTC Volatility Index settled at 3.05%, the lowest reading in five months, pointing to an unusual level of composure in a market that often trades on emotion.

Over 300,000 BTC changed hands within this range, with new accumulation zones forming near $111,000 to $113,000 and large holders distributing near the upper end.

Meanwhile, Bitcoin’s share of total market cap slipped from 59.1% to 58%, suggesting traders were exploring risk elsewhere but without abandoning their core positions.

Ethereum became the quiet centerpiece of that search for yield and structure. It ended September at $4,480, up 3.8% for the month, supported by staking participation climbing to 30.1% of supply. Lido (LIDO) and EigenLayer (EIGEN) remained the largest contributors to that figure.

Beyond staking, Ethereum’s role as a financial base layer deepened. Maple Finance (SYRUP), MatrixDock (XAUM), and OpenTrade expanded their issuance of tokenized bonds and credit assets directly on-chain, extending the bridge between decentralized networks and conventional finance.

The flow of capital beyond mainstream cryptos gained pace through the month. Pendle’s (PENDLE) total value locked rose to nearly $7 billion as institutional users sought structured yield on-chain.

Solana (SOL) and Avalanche (AVAX) benefited from renewed ETF-linked interest and integrations connecting blockchain data to artificial intelligence tools. Near Protocol (NEAR) followed a similar trajectory with partnerships focused on machine-learning data validation.

BNB Coin (BNB) gained 12% as Binance moved closer to a U.S. legal resolution, and Chainlink (LINK) continued its steady climb through new staking pools and wider use in reserve-verification systems.

The derivatives market remained the main driver of activity, accounting for more than 70% of total trading volume. BTC options open interest reached $18.2 billion, with traders positioning around the Sept. 26 expiry known as “Three Witches Day,” when futures and options across assets tend to settle simultaneously.

DeFi and perpetual DEX tokens emerged as the month’s outliers. Aster (ASTER) surged 1,851%, and Avantis (AVNT) climbed 152%, reflecting growing interest in decentralized derivatives and event-driven trading models.

Quiet repositioning across big money desks

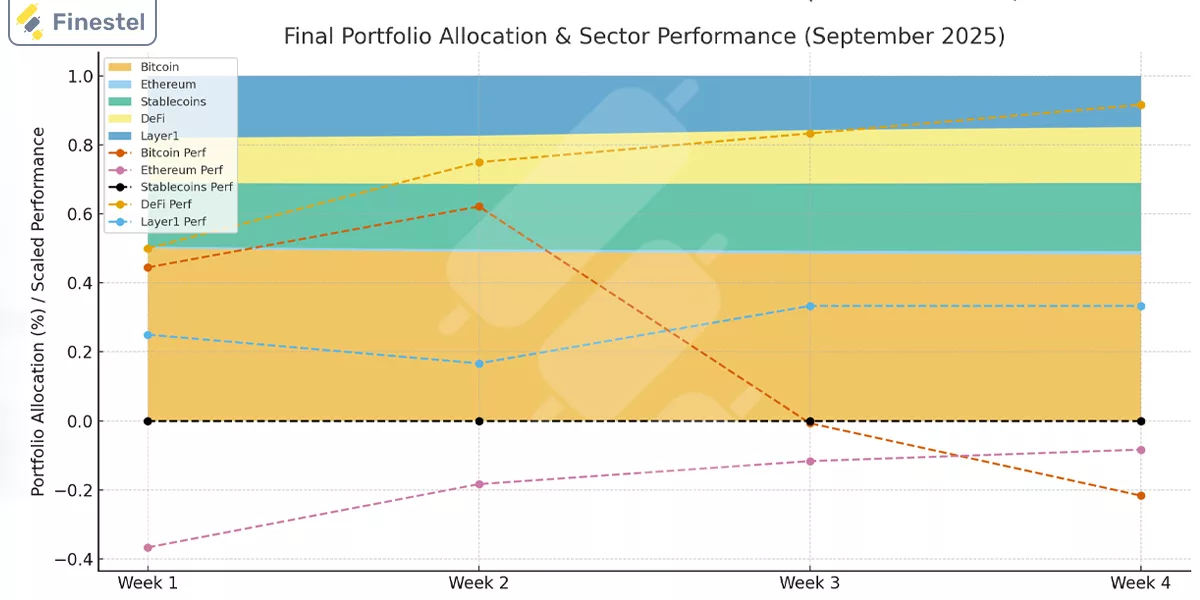

Bitcoin and Ethereum continued to form the core of institutional portfolios, yet their combined share slipped from 50.5% to 48.2%, while stablecoin holdings climbed to 19.8%, giving managers cash-like reserves to move quickly when conditions changed.

Allocations to DeFi and real-world asset protocols rose to 16.2%, while alt layer-1 and narrative-driven holdings stayed near 15.8%.

ETF flows reflected renewed optimism. Bitcoin and Ethereum exchange-traded funds brought in $1.37 billion in net inflows during September, led by BlackRock and Franklin Templeton.

Infrastructure growth also advanced. Fireblocks expanded its partnerships with HSBC and Société Générale, tightening the connection between banking systems and digital-asset storage networks.

Corporate treasuries added to the gradual momentum. Several firms increased their Bitcoin holdings in small increments, treating it as a strategic reserve similar to gold rather than a speculative trade.

Policy progress supported that confidence. The U.S. moved closer to resolving the Binance case, removing an obstacle that had weighed on sentiment. The U.K. passed its Digital Securities Regulation Bill, defining how on-chain instruments can operate under existing securities law.

The European Union advanced MiCA implementation, while South Korea aligned its stablecoin framework with the European model. Laos unveiled a 300-megawatt Bitcoin mining initiative aimed at attracting international investment.

Trading behavior through September followed the same measured rhythm. Professional desks limited per-sleeve losses to 6–8% and kept portfolio value at risk below 10%.

Finestel described the result as composure. Institutions had re-entered the market with rules, structure, and capital discipline, qualities that were missing in earlier cycles.

The overall setup heading into October resembles a market waiting for confirmation rather than chasing conviction and will test whether that composure can turn preparation into progress.